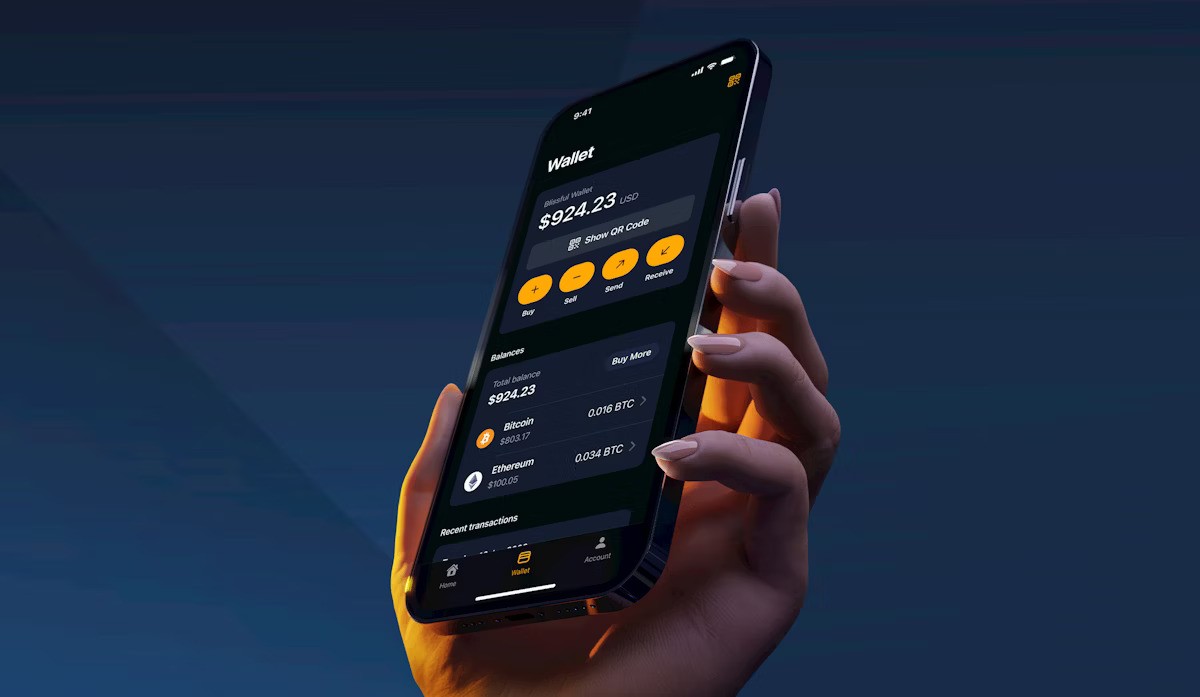

Cryptocurrency wallets have come a long way from being mere storage solutions for digital assets. Initially, they served as digital vaults, safeguarding private keys and enabling transactions. However, as the crypto space has evolved, so have wallets. Today, they are transforming into comprehensive financial ecosystems, offering a range of services beyond basic transactions MetaMask. This article explores how crypto wallets are evolving into multifaceted platforms shaping the future of decentralized finance (DeFi).

The Early Days: Secure Storage and Transactions

When Bitcoin was first introduced, the primary function of crypto wallets was simple: securely store private keys and facilitate peer-to-peer transactions. These wallets were divided into two main categories: hot wallets (connected to the internet) and cold wallets (offline storage). While security remained a primary concern, usability was often limited, making crypto adoption challenging for non-technical users.

The Rise of Multi-Functionality in Crypto Wallets

As blockchain technology advanced, crypto wallets started integrating additional features to enhance user experience and expand their utility. Some of the key developments include:

- Built-in Exchanges – Many wallets now include integrated decentralized exchanges (DEXs), allowing users to swap assets without relying on centralized platforms.

- Staking and Yield Farming – Users can now stake their assets directly from wallets, earning passive income without needing a separate DeFi platform.

- Multi-Chain Support – Modern wallets support multiple blockchains, enabling seamless transactions across different networks.

- NFT Management – With the rise of non-fungible tokens (NFTs), wallets have adapted to store, manage, and trade digital collectibles.

Security Innovations: Moving Beyond Private Keys

Security remains a fundamental concern for crypto wallet users. To address vulnerabilities, several innovations have emerged:

- Hardware Security Modules (HSMs) – Enhanced hardware wallets offer improved protection against cyber threats.

- Multi-Signature Wallets – These require multiple approvals before executing transactions, adding an extra layer of security.

- Biometric Authentication – Some wallets now integrate fingerprint or facial recognition for improved access control.

- Social Recovery Mechanisms – Instead of relying on a single recovery phrase, wallets now allow users to designate trusted individuals to help recover access in case of key loss.

The Future: Crypto Wallets as Comprehensive Financial Hubs

The next phase of evolution for crypto wallets is their transformation into complete financial ecosystems. Features likely to become standard include:

- Decentralized Identity (DID) – Wallets could serve as digital identities, allowing users to interact with decentralized applications (dApps) and financial services securely.

- Automated Financial Services – AI-powered wallets may offer personalized financial insights, automated investment strategies, and real-time risk analysis.

- Cross-Platform Integration – Wallets will increasingly connect with traditional financial services, enabling seamless fiat-to-crypto transactions.

Conclusion

Crypto wallets are no longer just digital vaults—they are evolving into powerful financial ecosystems that facilitate seamless transactions, asset management, and financial growth. As security, functionality, and user experience continue to improve, crypto wallets will play a pivotal role in the mainstream adoption of digital assets.